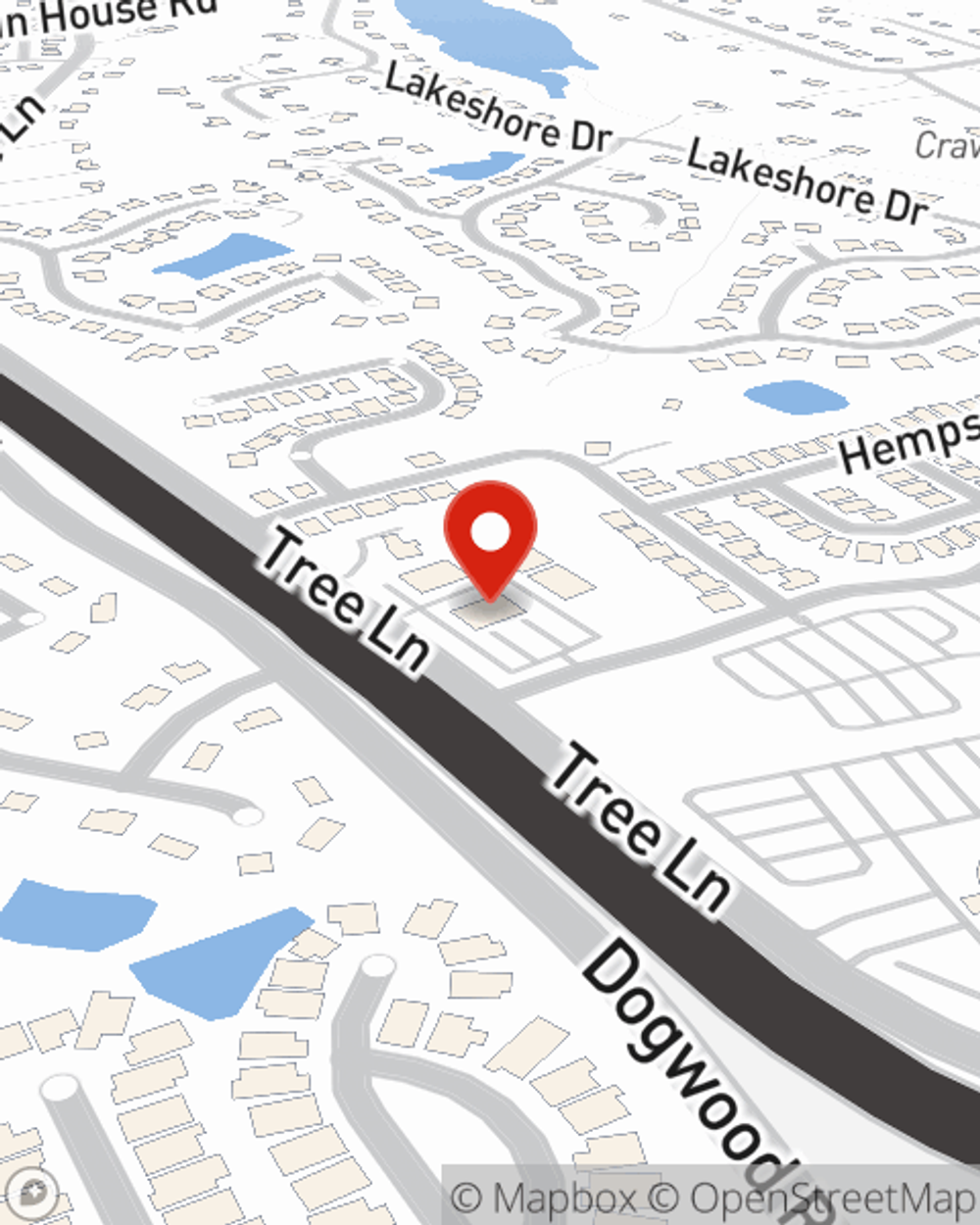

Business Insurance in and around Snellville

One of the top small business insurance companies in Snellville, and beyond.

Cover all the bases for your small business

- Snellville

- Grayson

- Loganville

- Monroe

- Lilburn

- Lawrenceville

- Buford

- Norcross

- Duluth

- Braselton

- Dacula

- Auburn

State Farm Understands Small Businesses.

Though it's not a pleasant thought, it is good to recognize that some things are simply out of your control. Mishaps happen, like an employee gets injured on your property.

One of the top small business insurance companies in Snellville, and beyond.

Cover all the bases for your small business

Surprisingly Great Insurance

The unexpected is, well, unexpected, but that's all the more reason to be prepared. State Farm has a wide range of coverages, like a surety or fidelity bond or worker's compensation for your employees, that can be created to develop a customized policy to fit your small business's needs. And when the unexpected does arise, agent Sean Johnsen can also help you file your claim.

So, take the responsible next step for your business and get in touch with State Farm agent Sean Johnsen to discover your small business insurance options!

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Sean Johnsen

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.